2021 was a standout year for UK real estate, which delivered annualised total returns of 14.7% to the end

of October, as robust income returns were complemented by the return of capital growth. This represents the

highest level of annualised total returns since the pre-Brexit days of mid-2015. While we don’t expect 2022

to deliver the same capital value growth as 2021, it is likely to witness similar positive supply and demand

dynamics which should maintain market momentum.

If 2021 was the year of recovery, 2022 is likely to be one of

momentum. The prevailing broad-based occupational recovery

is not immune to economic headwinds (the government’s

recent move to “Plan B” is the most tangible evidence of

this, but supply-side pressures are also likely to remain as

the economy adjusts to the recovery); however, it has proved

remarkably resilient through challenging circumstances.

Occupier sentiment, with some notable exceptions, remains

positive and we are starting to see encouraging signs of business decisions which were postponed during the

pandemic begin to translate into an increase in occupier

activity. In the capital markets, investor sentiment remains

broadly positive, as evidenced by a recovery in transactional

volumes, with significant capital reportedly raised for

deployment, targeting a market expected to outperform

global strategies in the short term.1 The “All Property” Net

Initial Yield of 4.7%2 continues to offer highly attractive

relative income attributes over gilt and base rates.

Occupational dynamics differ at sector level, and portfolio managers will

have to stock pick with increasing precision to deliver outperformance.

Offices, retail and alternatives – for example, hotels and leisure – emerged

from the pandemic having been profoundly affected by shifting sentiment.

However, our experience from the front line is more positive, and we

expect these sectors to continue to recover – albeit at different speeds

and to different degrees. By way of illustration, we have been advocates of

low-rented convenience/discount-led retail warehouses for some time, as

evidenced by our deployment of significant investment in the sector in 2021.

Yields contracted sharply through the year as investor appetite for the sector

increased, however it still looks attractive as an income-led proposition.

Our high conviction view towards retail warehouses is based on

intelligence from our asset management colleagues indicating a vibrant

occupational market with tenants benefitting from reduced competition

and online resilience, and in many cases online synergies – for example,

“click and collect”. We complement this high-level conviction with forensic

asset-by-asset due diligence to ensure we invest in the right schemes in

the right locations, let to tenants known to trade well.

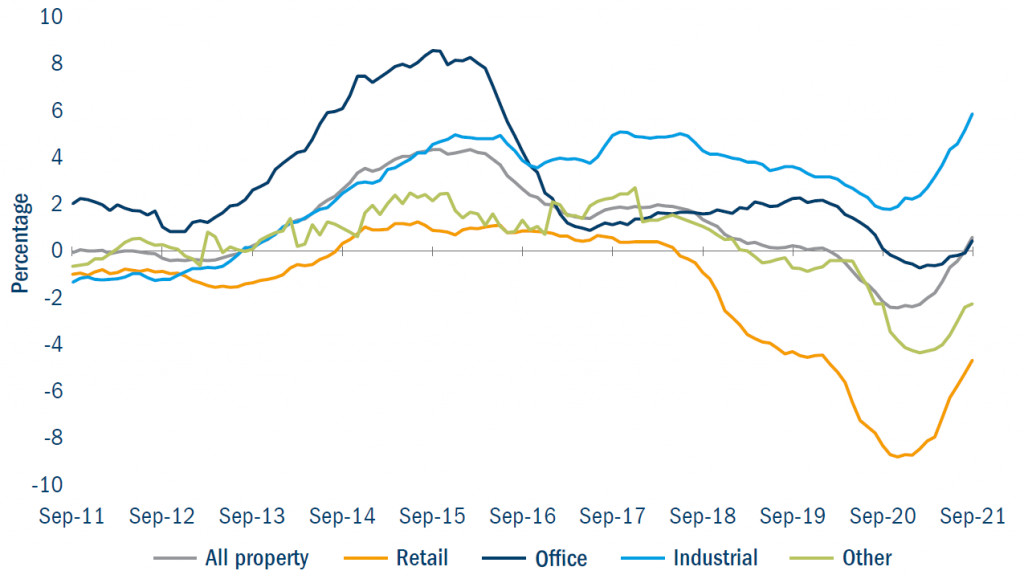

Industrials continue to benefit from sustained structural imbalances in

favour of landlords, which led to record levels of rental growth over the

past 12 months (6.6% to the end of October 2021, as per the MSCI UK

Property Monthly Index). Demand continues to increase as retail sales

migrate online, and other, new occupiers enter the market, for example

“dark kitchens” – shared physical premises where small businesses

can set up to provide delivery-only takeaway meals. Investor sentiment,

unsurprisingly, remains very positive towards the sector, and as a result

we have seen significant yield compression for both logistics and multilet

assets throughout the UK. Given that industrials account for more

than 40% of the index composition, this has a disproportionately positive

impact at market level.

Fig 1: 10-year UK commercial property rental value growth (annualised)

Source: MSCI UK Monthly Index, as at September 2021.

ESG (environmental, social and governance) factors will rightly continue

to influence investment decisions. Investment approaches are split

broadly between those passively buying best-in-class, and those willing

to actively manage portfolios to deliver building improvements. Prevailing

pricing is likely to reward the latter more than the former, while the middle

ground gets increasingly squeezed and at risk of stranding. We have

committed to net-zero carbon in our portfolios by at least 2050, and we

continue to implement workstreams aimed at quantifying works required

to accelerate the trajectory towards net zero, implementing refurbishment

and improvement works at a sustainable scale, and articulating the results

of those activities to our clients.

Taken together, UK real estate continues to represent attractive value on

an income basis, with modest but sustained growth potential in 2022.